For companies expanding further into Europe, Spain provides a compelling and thriving market. This is especially so when serving the Spanish market in its consumers’ preferred languages, online.

Spain has become an appealing market for brands that want to expand in Europe. In fact, many of MotionPoint’s clients follow a market expansion strategy nicknamed “FIGS”: France, Italy, Germany, and Spain. Users from these markets are very sensitive about buying on websites that don’t use their language.

Spain is no exception. English fluency is increasing, but currently only 27% of Spain’s population speaks English. With Spanish (and other non-English languages) remaining the preferred language of this market, the best way to serve these consumers online is with localized content and shopping experiences.

Why should companies expand into Spain? What cultural or linguistic nuances await expanding businesses? How can companies generate meaningful engagement with online Spaniards? Read on to learn more.

Like much of Europe, the Spanish economy experienced a “double-dip recession” from 2008 to 2013, but its recovery really took off early 2014, The Economist recently reported. Its economy grew by 3.2% last year, one of the fastest rates of expansion in the EU, according to Financial Times.

This year has been especially good for Spain’s economy, which provides favorable conditions for expanding companies. It experienced growth of nearly 1% in Q1 (at an annualized rate of 3.8%) and 1% in Q2. An acceleration in private consumption is widely credited for the recent robust upswing.

Falling oil prices have also boosted disposable income within the market. Spanish businesses are benefitting from the decline of the Euro and super-low interest rates. Spain’s unemployment rates continues to drop dramatically—a great thing—though joblessness remains a concern. More good news for expanding companies: Compared to European markets such as Germany and France, Spain is a far less competitive market. We’ve recently reported how businesses often find greater success in smaller, less competitive global markets than larger ones. Why? Fewer domestic retailers (as seen in Spain) usually means local consumers are underserved. This boosts consumer demand for cross-border solutions.

In fact, Spaniards already do much of their online shopping on cross-border websites. Since 2013, Spanish consumers have bought more on foreign e-retail sites than domestic ones.

Online Spaniards are also generally less demanding when it comes to customer service, especially when compared to German and French consumers. This more laid-back perspective can reduce costs and risk regarding returns. (We recently reported about the high expectations French consumers have for online customer service.) Spaniards are also more understanding of longer delivery times, which bodes well for cross-border e-retailers.

Another compelling reason to serve Spain with localized websites and content: the “halo effect” it creates by generating traffic and revenue not only from local Spaniards, but also from Spanish-speaking markets in Latin America. You’ll learn more about this phenomenon a bit later in this post.

Internet penetration is quite high in Spain—over 82% of the population uses the Internet. And they use it quite a bit: 90% or more of Spaniards aged 24 to 44 use the Internet every day. Over 80% of slightly younger and older demographics use the Internet every day, too.

They’re also social-network savvy—nearly half of the Spanish online population currently uses social networks, much higher than the global average. They use an average of three social networks; Facebook, YouTube and Twitter are among the most popular. Sixty percent of users check their social networks at least once a day. (Twenty-five percent say they “continually” check their networks throughout the day.) Six in 10 social media users will have Facebook accounts in two years.

Over 40% of Spain’s online consumers shop on e-commerce sites, and they’re big spenders: they spend an average of €1,354 (or around $1,520 USD) online last year, a 2% increase over 2014.

Last year, Spaniards made nearly one-third of their total purchases online, up from 25% the year before. Even Spaniards aged 50 and older, who were once reluctant to shop online, are increasingly adopting the practice.

Thirty-five percent of Internet-connected Spaniards shop online at least once a month, a recent study suggests. Nearly half make online purchases between one and four times a year.

This translates into strong year-over-year growth for Spanish e-commerce. It reached €16.9 billion in 2014 (around $19 billion USD), representing a YoY growth of nearly 17%. The most popular product categories purchased online include fashion (65%), travel (59%), consumer electronics (55%) and books and CDs (46%).

For online transactions, over half of Spaniards prefer to pay with credit cards. Electronic bank transfers and e-wallet platforms are growing in popularity. Retailers should support popular local banking cards such as Sistema 4B and Euro6000.

Spain’s population may be playing catch-up with Europe as it embraces e-commerce, but it practically leads the pack in mobile e-commerce. In fact, it beats the UK in its percentage of mobile-phone users who own smartphones. Nearly 70% of Spanish mobile-phone owners use a smartphone. (This will reach nearly 75% in three years.)

Spain’s mobile Internet penetration rate is over 60%. Smartphone users spend 1 hour and 45 minutes browsing the web on their devices every day. Eight in 10 users search for products and services; 25% of users use their smartphones to make purchases.

Spanish is the naturally Spain’s official language, spoken by 99% of the population. The Spanish spoken in Spain—known as Castellano or Castilian Spanish—has linguistic differences from the variations of Spanish spoken in Latin America.

However, the country has several regional “co-official languages” too, including Catalan (spoken by 17% of the population), Galician (7%), and others.

Companies that want to serve Spaniards online should operate localized Spanish-language sites. But in our experience, companies that also publish sites in the Catalan language stand to generate more total engagement and conversions in the market than by publishing a Spanish site alone.

Catalan is spoken in three east and northeast regions of Spain: Catalonia, Valencia and the Balearic Islands. While the majority of residents in these regions speak Spanish, enough speak Catalan as a first language to warrant consideration for localization—particularly when serving consumers in the Catalonia region.

Catalonia is Spain’s largest autonomous community by GDP. It’s also the home of Spain’s second largest city by population, Barcelona.

If you’re expanding into Spain online, serving customers in Barcelona is a must. This requires a proactivity when it comes to reaching as many Catalonian consumers as possible.

One of MotionPoint’s retail clients, which recently expanded into the Spanish market, experiences about half of its Spain-based “store locator” searches from Barcelona residents. More than half of Barcelona’s population speaks Catalan; the language is visible on road signs, in advertisements and in the local media.

Barcelona’s influence in Spain-based e-commerce is quite strong, based on Q2 2016 data gleaned from operating many sites serving the market. Barcelona-based web traffic drives about 20% of all traffic in Spain.

Residents in Barcelona also generate much more engagement and transactions than the Spanish average:

Average order values are higher, too:

And bounce rates are lower:

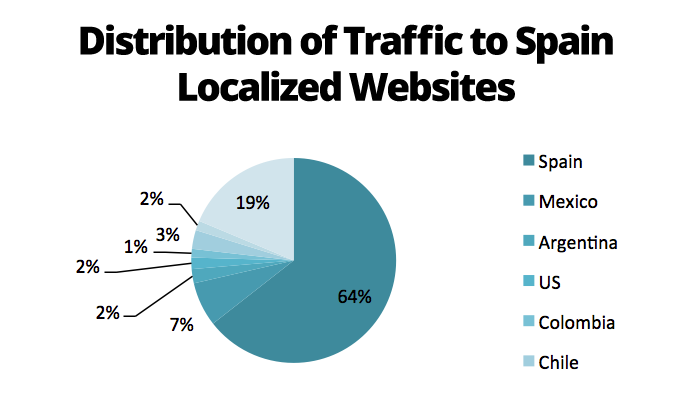

As we mentioned earlier, an unexpected upside of engaging Spain’s online consumers in their languages of choice is the lift in traffic and transactions these localized sites often see from consumers in other global markets.

Based on our data, about 65% of traffic to our sites serving Spain hail from users living in Spain. But the rest comes from other Spanish-speaking markets such as Mexico, Argentina and other Latin American markets.

We’ve seen similar a “halo effect” when U.S. companies launch Spanish-language sites to serve U.S. Hispanics. We’ve found that cross-border orders from Latin American consumers can dramatically increase—but only when companies appropriately support these markets’ payment platforms, and can ship internationally.

Sites serving Spain should be no exception. We advise companies expanding into the market online to assess the option of fulfilling to Latin America and other global markets. This is a successful strategy that’s followed by such Spanish fashion powerhouses as Zara and Desigual, which have significant retail presences in Latin America and the U.S.

The takeaway is clear: Serving Spain’s online consumers in Spanish and Catalan ensures maximum reach within the Spanish market—and it can lead to brand awareness, engagement and conversions in other global markets, too.

Would you like learn how MotionPoint can help you enter Spain’s online market easily, quickly and affordably? Contact us for more information.