Last week, we provided a helpful primer on the Russian social media landscape, highlighting key Russian-owned social networks such as VK, and how U.S.-based networks like Facebook measure up in the market.

In this conclusion to our two-part series, we’ll present exclusive data and insights about Russian social media, to help Western companies and marketers make better decisions when engaging Russian consumers online.

We recently examined the performance of several localized Russian websites that MotionPoint operates for major global e-commerce brands. These clients have followed MotionPoint’s best practices, and have invested effort and resources to make their Russian sites successful. All of the examined localized sites have been in-market for at least three years.

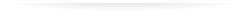

Let’s start with a table summarizing the key metrics we monitored on our localized Russian sites. We used platforms such as Google Analytics and others to track user activities across Russian social media platforms, and how those users interacted with the localized sites we operate.

We examined the performance of three social networks:

When we compare the average order values (AOV) generated by networks VK and Odnoklassniki, the similarities are clear.

Most of the Western companies we work with in Russia tend to focus exclusively on VK as their local social media channel, using the network to represent their local “voice.” These companies often employ Russian speakers to maintain their VK social channels by engaging with followers, promoting specials, and answering support questions.

Given VK’s massive reach in the country, leveraging VK for these purposes is an obvious best practice—and any cost to hire Russian speakers to operate a VK company page is easily offset by the referral traffic and revenue the page helps generate. It’s a worthy investment.

Odnoklassniki doesn’t have the same widespread adoption by our Western clients that VK does. While nearly all of our clients in Russia have operated Odnoklassniki pages for their companies in the past—and for an average of about two years—few still do. Why? We suspect it’s because of the network’s relatively intimidating, mostly-in-Russian marketing interface (which demands the continued use of a Russian agency), and the older skew in active users.

However, companies that still use the network for marketing and customer engagement are generating interesting results. For instance: Odnoklassniki has a noticeably higher conversion rate than VK. Our insights suggest this is due to a smaller number of users coming from the channel—though the ones who do are more likely to have the capital to spend.

MotionPoint believes there’s still value in leveraging Odnoklassniki, especially to reach particular online demographics. With judicious experimentation, companies keen to connect with Odnoklassniki’s core demographic of women, aged 35 to 44, can generate compelling results.

As we mentioned last week, Russian Facebook users are generally better-educated than users on VK and Odnoklassniki, and likely more affluent. This is illustrated by Facebook’s noticeably higher AOV in the above chart. Conversion rates were generally below that of Odnoklassniki , but were competitive with VK.

For one of our clients—a fashion retailer—Facebook was actually the highest converting social media channel in Russia. This dovetails nicely with the company’s mass-market Western fashion products. We suspect luxury fashion retailers and companies in the travel industry might find particular success using Facebook for audience engagement and marketing.

It is no secret that the Russian economy has been in a slump. Ongoing economic sanctions targeted at large Russian conglomerates, and the plummeting price of oil, have put severe strain on the economy.

To exacerbate matters, closed access to capital markets in the last two-and-a-half years has caused inflation to more than double. The RSX ETF—a guide that broadly tracks the Russian market’s performance—has dropped approximately 50% in the past two years. Corporations and consumers alike are struggling, and have been forced to adjust to tighter budgets. Western companies targeting Russian consumers would do well to acknowledge these factors, and how they impact customers’ spending.

According to a recent survey by the National Opinion Research Center in association with the Associated Press, Russians have differing opinions on the impact of these economic challenges. For instance: Moscow residents are more likely believe that sanctions have impacted their family’s finances (63% vs 43%). Wealthier Russians with a monthly income of over 34,000 rubles (approximately $510, a key demographic for Western companies) are more likely to believe that sanctions have had negative nationwide impacts than those with lower monthly incomes of 17,000 rubles (about $257).

These economic shifts impact which social media networks Western companies should choose to use for customer engagement. According to a 2014 TNS Russia report, VK users are often of lower socio-economic standing than users of networks Odnoklassniki and Facebook. Approximately 20% of VK’s users are students. About 7% are unemployed.

Furthermore, the study found that 6.5% of VK users could afford to purchase only food. Nearly half (46.5%) could afford only food and clothing. Only about one-third of VK users has the discretionary income to purchase more expensive items, the reports said.

Western consumer retail and fashion brands operating Russian sites will compete with comparatively cheaper domestic brands—not to mention Chinese items that have recently flooded the market. (Chinese virtual mall Alibaba is a wild success in Russia.) A word of advice: note these competitors’ pricing, but don’t feel obligated to match or beat them. Western products will almost always cost more than domestic goods—even if those products are likely categorized as modestly-priced in Western markets.

Rather than drop prices, roll with Russia’s current economic climate (which may temporarily place your products into a sub-premium or premium category). Attempt to offset significant revenue losses by wisely connecting with affluent consumers on social networks such as Facebook and Odnoklassniki. Between Facebook’s well-educated, more Westernized consumers and Odnoklassniki’s older, predominantly female users, your company will likely find a relevant and interested audience.

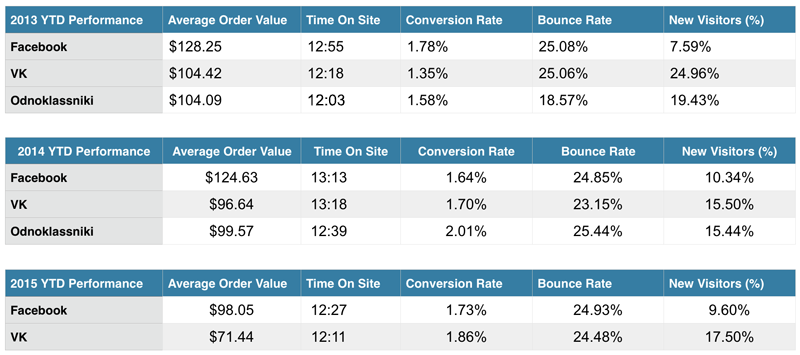

We recently analyzed the Consumer Price Index (CPI) inflation in Russia from May 2013 to September 2015 alongside our clients’ average order values generated through VK and Facebook. As the above chart suggests, Facebook consistently has a higher AOV than VK, even with rising inflation.

Facebook-affiliated users spend approximately 16% more than the site average, and 29% higher than VK-affiliated users. In addition, Facebook continuously outperforms the average for the sites, in contrast to VK’s underperformance relative to the site.

A 2014 decrease in AOV for both social media channels coincides with Russia’s massive increase in inflation during the same year. We have no doubt that ever-rising inflation rates (representing a general downturn in the Russian economy) affected consumer confidence and spending.

This decrease appears to have affected both Facebook and VK equally, indicating that if both networks have different socio-economic levels of users (which is very likely), they are both being affected. Facebook users appear to be able to spend more, even in the economic downturn—an important distinction for upscale Western brands to keep in mind.

Western companies already operating in Russia may be concerned about their business performance, particularly considering Russian’s current economy. These organizations should consider:

In contrast, companies that are looking to enter Russia should note our findings, and enter the market with VK and Facebook social profiles as part of their plans. VK will assure the greatest reach and amount of engagement with the market; Facebook can help you target a more lucrative demographic that’s better-insulated from the current economic fluctuations.

Pure plays would do well to consider engaging with Russian Facebook users in some form, whether through remarketing advertisements or engagement with a Russian-language company page. Brick-and-mortar retailers should follow a similar strategy, while also using city-level geo-targeting to target the higher proportion of Russian Facebook users populated in larger cities (to support in-store promotions or campaigns).

While Odnoklassniki has a wealthy user base similar to Facebook’s, it’s generally harder for Western companies to launch and maintain brand pages, and set up social marketing campaigns. For a Western company’s earliest days in Russia, it’s smart to stick with Facebook—rather than Odnoklassniki—as the compliment to VK.

Looking toward the future, Russian sentiment should stabilize as the current economic situation becomes the new norm. Barring any more drastic shocks to the economy (increased sanctions, further decreases in the price of oil or increases in inflation) companies can anticipate stabilization in terms of AOV from these social media channels.

Winning in Russia is well within many companies’ reach, with the right market insights and smart social media marketing. With a great localization partner, social networks in Russia can be understood, and campaigns can engage and resonate with Russian consumers—while still accounting for Russia’s current economic realities.